Third-Party’s Balance Sheet Borrowing

The idea of borrowing a third-party balance sheet is the following:

High Finance

High Finance is not only made out of bigger numbers than finance. High Finance is a completely different reasoning from Finance. One used to illustrate

Our Deal Focus

We focus on deals whose budget is above USD 100 million and where initial equity already invested is at least USD 10 million.Moreover, the company,

Our Precious Time

Time is the most valuable and precious thing in life. You have heard this many times but it’s worth recollecting no matter how many times.

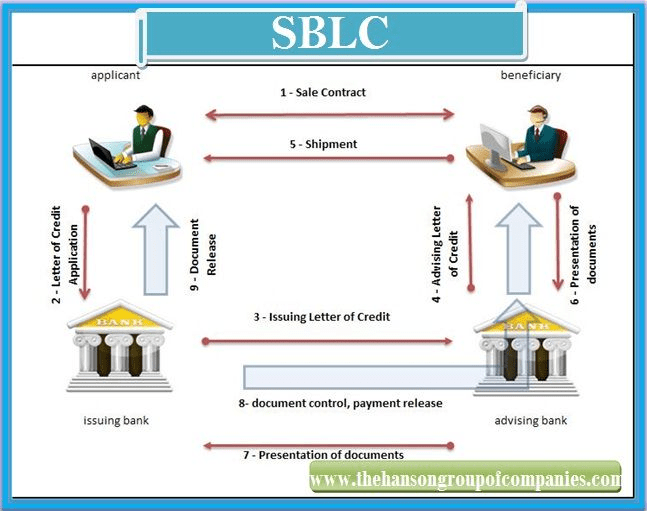

Standby Letter of Credit

Definition A standby letter of credit (SLOC) is a guarantee of payment by a bank on behalf of their client. It is a loan of

The Costs of the Deal

Many businesspeople come to me to ask me help them close multimillion and sometimes multibillion deals. They are broke but in their mind, this is

Accessing High Finance

Accessing the High Finance World Accessing the High Finance World is a long and complex process. It involves professional, intellectual and social skills and requires

Syndication of Institutional Investors

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Capital Requirements Levels

The various Levels Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. What does it take

Collaterals

Collateral Definition Collateral, especially within banking, traditionally refers to secured lending (also known as asset-based lending). More-complex collateralization arrangements may be used to secure trade